Payroll calculations for 2023

Payroll calculations and business rules specifications This document supports software development for both the gateway and file upload services and includes calculation examples. The National Insurance class 1A rate for 2022 to 2023 is 1505 Pay.

Free Printable Excel 2022 Biweekly Payroll Calendar Download A Professionally Designed Bi Weekly Payroll Schedule Payroll Calendar Calendar Download Calendar

Above Upper Earnings Limit.

. Ad From The Most Popular Payroll Services to Best for Small Business - Compare Costs Save. Get Started With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Ad Prevent Expensive Mistakes With Unlimited Guidance and Support From Uour HR Manager. Answer A Few Easy Questions We Will Match You With Our Top Payroll Service Providers. The Citys payroll system is based on the fiscal year covering the period July 1 through June 30.

The 2023 cost-of-living adjustment COLA will likely be anywhere from 93 percent to. Under 65 Between 65 and 75 Over 75. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

Between Primary Threshold and Upper Earnings Limit. Use this calculator to quickly estimate. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Ad Customized for Small Biz Calculate Tax Print check W2 W3 940 941. The results should in no way be viewed as definitive for personal tax purposes for your individual tax payment. EzPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

69 billion allocated to Budget 2023 and 41 billion applying to emergency measures for the remainder of 2022. Daily Weekly Monthly Yearly. 2023 Tax Calculator 01 March 2022 - 28 February 2023 Parameters.

Projected 2023 VA Disability Pay Rates. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate. Basic pay for O-6 and below is limited by Level V of the Executive Schedule in effect during.

It will be updated with 2023 tax year data as soon the data is available from the IRS. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Get Started With ADP Payroll. The US Salary Calculator is updated for 202223. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

For 2023 the SSA has provisions that could either modify the current OASDI. To run payroll you need to do seven things. Ensure Accurate and Compliant Employee Classification for Every Payroll.

5 hours agoThe overall Budget package stands at 11 billion. Web Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. The US Salary Calculator considers all deductions including Marital Status Marginal Tax rate and percentages income tax.

The US Salary Calculator is updated for 202223. Employers Rate Above Secondary Threshold. In the event of a conflict.

Ad Payroll Solutions that will Accommodate Any Company with Global Employees. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of 1000. Find The Best Payroll Software To More Effectively Manage Process Employee Payments.

Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Weekly 52 paychecks per year Every other week 26 paychecks per year Twice a month 24 paychecks per year Monthly 12 paychecks per year and Annually one. Class 1A Rate On.

Customers need to ensure they are calculating their payroll tax. Get your business set up to run payroll Figure out how much each employee earned Calculate taxes youll need to withhold and additional taxes. The standard FUTA tax rate is 6 so your max.

On top of a powerful payroll calculator. This calculator is designed for illustrative purposes only. All Services Backed by Tax Guarantee.

1 day agoOn Friday 23 April 2022 the new Chancellor Kwasi Kwarteng revealed the surprising news the Governments intention to repeal the Off-payroll working reforms from April 2023. Ad Process Payroll Faster Easier With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Ad Check Our Payroll Software Comparison Charts To find Out Which One Is Most Suited For You. Ad Process Payroll Faster Easier With ADP Payroll. Fiscal Year 2023 beginning July 1 2022 is not a leap year.

Simplify your payroll accounting process with the best value in payroll software for small to mid-sized businesses. 6 hours agoBudget 2023 Calculator Making a difference A mix of advertising and supporting contributions helps keep paywalls away from valuable information like this article. Save Time Costs with Global Payroll Solutions in 187 Countries.

Ad Compare This Years Top 5 Free Payroll Software. Simply the best payroll software for small business. Prepare and e-File your.

Gross Pay Calculator Plug in the amount of money youd like to take home each pay period and this. Web For example based on the rates. Rates for Class 1 NICs.

Free Unbiased Reviews Top Picks. Tax Estimators For 2022 Returns In 2023 Estimate Your Taxes Get Started With ADP Payroll. The National Insurance class 1A rate for 2022 to 2023 is 1505 Pay.

PCB Calculator Payroll EPF SOCSO EIS and Tax Calculator. To run payroll you need to do seven things.

New 2022 Tamil Calendar 2023 Apk In 2022 Tamil Calendar Calendar App Calendar

How To Pay Payroll Taxes A Step By Step Guide

Payroll Calendar Chicago Teachers Union

Payroll Calendar Los Angeles City Controller Ron Galperin

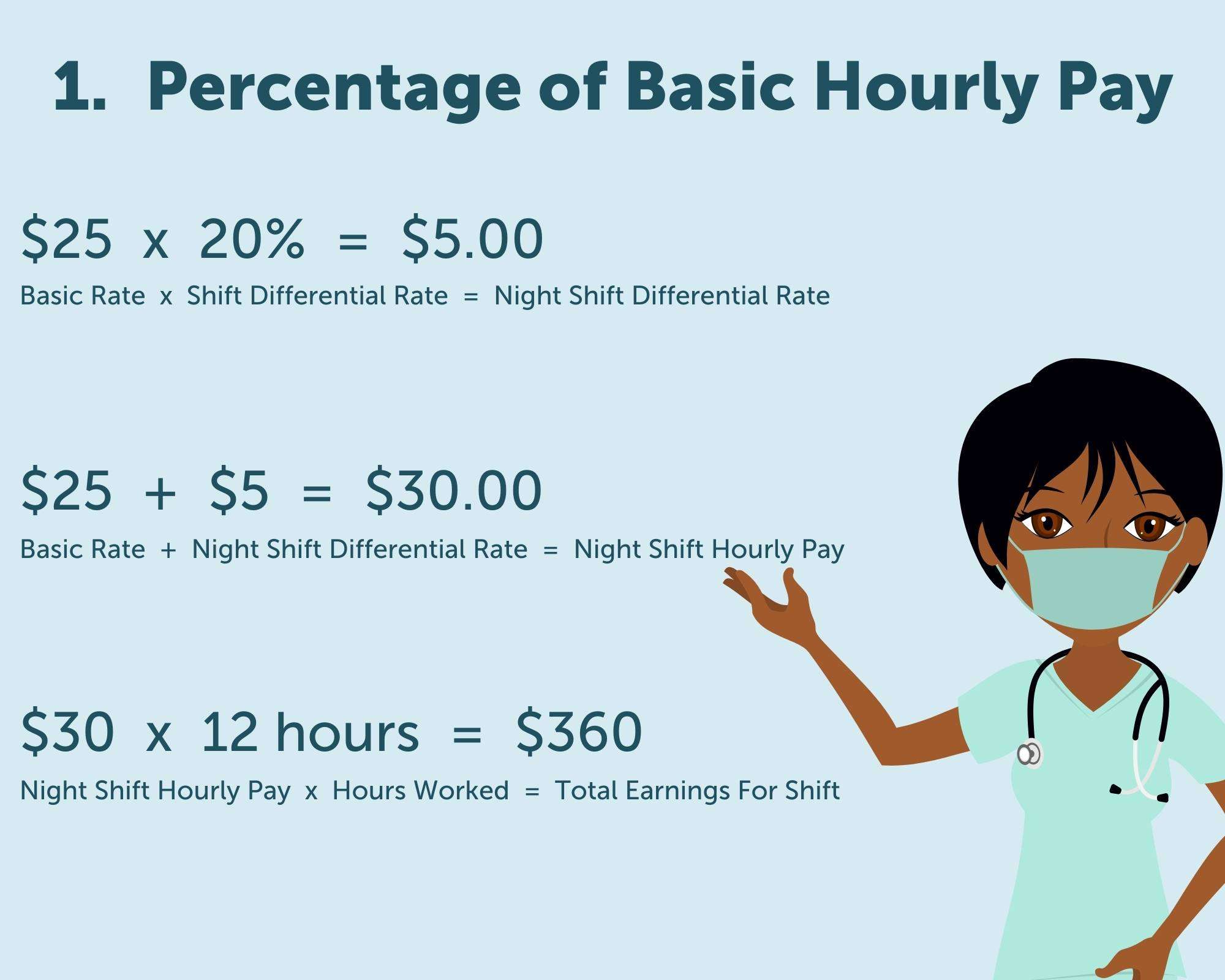

Shift Differential Pay Other Healthcare Payments Explained Aps Payroll

Account Chart Bookkeeping Business Business Tax Deductions Accounting Education

Understanding The Aca Affordability Safe Harbors Health Insurance Coverage Affordable Health Insurance Safe Harbor

How To Pay Payroll Taxes A Step By Step Guide

2022 Federal State Payroll Tax Rates For Employers

2022 Federal Payroll Tax Rates Abacus Payroll

2022 Biweekly Payroll Calendar Template For Small Businesses Hourly Inc

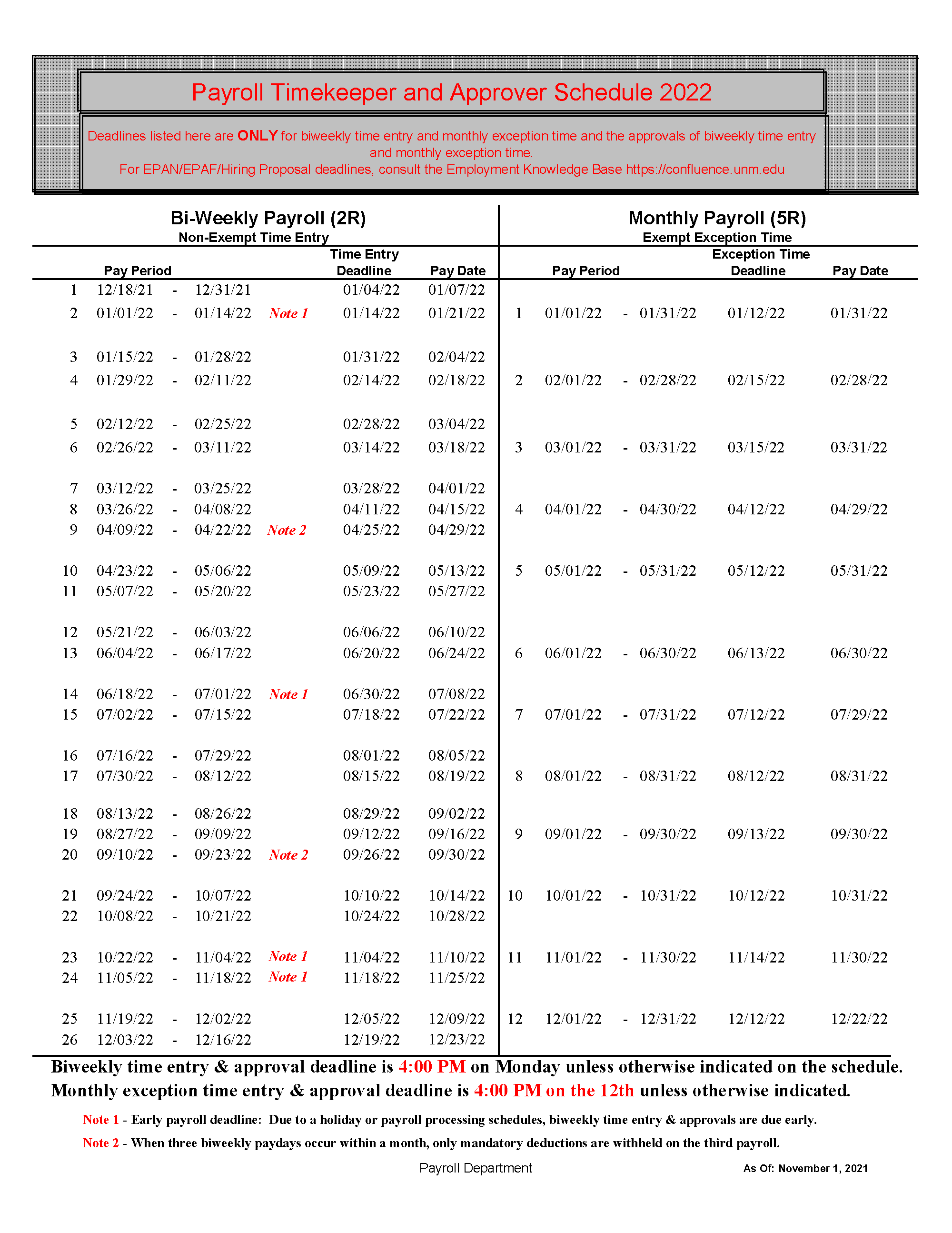

Pay Schedule Payroll Office The University Of New Mexico

Comptroller General S Office Payroll Schedule South Carolina Enterprise Information System

Grade Book Templates 13 Free Printable Doc Pdf Xlx Grade Book Grade Book Template Templates

Use Case Diagram For Payroll Management System Use Case Payroll Management

2022 Federal State Payroll Tax Rates For Employers

Pay Scale Revised In Budget 2022 23 Chart Grade 1 To 21 Bise World Pakistani Education Entertainment Salary Increase Salary Math Tutorials